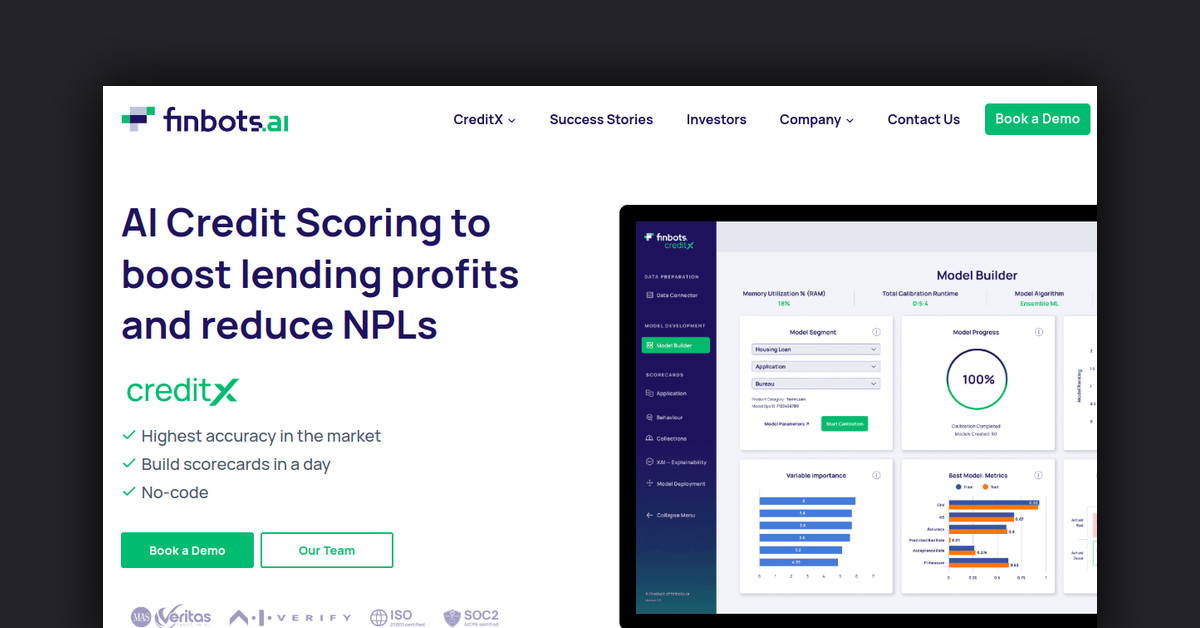

Revolutionizing Credit Risk Modeling with finbots.ai

finbots.ai is a pioneering AI-powered platform that is transforming the lending industry. The company’s flagship offering, creditX, empowers lenders to rapidly build and deploy highly accurate credit risk models known as scorecards. Leveraging advanced AI algorithms and machine learning techniques, creditX enables lenders to streamline the end-to-end credit risk modeling process, from data ingestion to model deployment, in just one day – a remarkable feat compared to the typical 9-12 month timeline.

Unlocking the Power of AI for Lenders

The creditX platform is designed to be user-friendly and accessible for lending professionals, even those without coding expertise. The platform’s intuitive workflow guides users through key steps:

-

Data Ingestion: Easily connect and ingest data from a wide range of internal, external, and alternative sources. The platform handles data validation, transformation, and encoding automatically, ensuring seamless integration.

-

Feature Engineering: Leverage over 100 auto-derived variables, powered by finbots.ai’s proprietary algorithms that identify non-linear relationships and select the optimal variables for building accurate models.

-

Model Building: Configure model parameters and instantly generate new models to assess the impact on Probability of Default (PD). Easily tweak and refine models to align with specific business objectives.

-

Model Validation: Utilize finbots.ai’s proprietary trained frameworks to rigorously cross-validate models, ensuring maximum accuracy and reliability.

-

Model Deployment: With a single click, deploy models via API, enabling real-time credit decisions and seamless integration into lenders’ existing workflows.

-

Monitoring: Leverage built-in monitoring, analysis, and reporting capabilities to continuously track model performance and make informed adjustments as needed.

Empowering Lenders Across the Spectrum

finbots.ai’s creditX platform supports a wide range of lending use cases, including:

- Consumer Lending: Application scorecards for personal loans, credit cards, auto loans, and more

- SME Lending: Efficient underwriting models for small business lending

- Commercial Lending: Corporate lending models to accurately evaluate risk

- Credit Line Increase: Behavioral models to identify customers for line increases

- Early Delinquency: Collection scorecards to predict and manage new delinquencies

- Debt Collection: Prioritize and segment customers for targeted collection activities

Whether you’re a bank, fintech lender, NBFC, or any other credit provider, finbots.ai’s AI-powered solutions can help you streamline credit risk evaluation, improve decision-making, and drive better business outcomes.

Proven Results and Expanding Footprint

finbots.ai has already established a global client base, serving leading banks, fintechs, and lending institutions across regions. The company’s AI solutions have demonstrated tangible impact, including:

- Increasing consumer loan approvals by 15% with lower default rates for a Southeast Asian bank

- Enabling a Nigerian fintech lender to expand financial inclusion for underserved MSMEs

- Helping a Middle Eastern bank increase credit card approvals by 25%

With a seasoned leadership team comprising former banking executives and data science experts, finbots.ai is poised to continue revolutionizing the lending industry by empowering lenders to make more informed, data-driven decisions through the power of AI.